As a corporate group that contributes to a sustainable society, the Carlit Group will continue to meet new challenges as a united team.

Review of operations for the fiscal year ending March 31, 2024

In the fiscal year ended March 31, 2024, net sales were ¥36,577 million, operating profit was ¥3,352 million, ordinary profit was ¥3,600 million, and profit attributable to owners of parent was ¥2,598 million. In fiscal year 2024, the impact of a weak global demand for semiconductors continued, and sales and profits in the Electronic Materials and Silicon Wafer sectors declined due to inventory and production adjustments by customers. However, consolidated operating profit, ordinary profit, and net profit were record highs for fiscal 2023 in all other business areas, as society and the economy continued to normalize due to the easing of behavioral restrictions caused by COVID-19. In addition, implementation of the initiatives in the Mid-Term Management Plan "Challenge 2024" and "Rolling Plan 2023" led to improvements in business operations, cost reductions, etc., resulting in an operating margin that increased 1.9% compared to fiscal year 2023.

Consolidated Financial Highlights (Millions of yen)

-

-

Net sales

-

36,577

(+1.6% YoY)

-

-

-

Operating profit

-

3,352

(+27.0% YoY)

-

-

-

Ordinary profit

-

3,600

(+23,7% YoY)

-

-

-

Profit attributable

to owners of parent -

2,598

(+15,7% YoY)

-

Forecasts for the fiscal year ending March 31, 2025

In fiscal year 2025, as in fiscal year 2024, the Chemical Products Business (The Explosives sector , the Chemicals sector, etc.), Bottling Business, and Engineering Services Business are expected to remain strong in line with domestic economic trends. In line with the recovery in the semiconductor cycle, we expect the Electronic Materials sector, which had been sluggish, to recover starting from the first half of fiscal year 2025, and the Silicon Wafer sector to start recovering from the second half of fiscal year 2025, and so we forecast an increase in sales and profit compared to fiscal year 2024. By promoting the five strategies listed in the mid-term management plan (Accelerate growth businesses, Expansion of R&D, Improving profitability of existing businesses, Advancement of ESG management, and Rebuilding of business infrastructure), we will not only promote business performance but also enhance capital profitability and improve our market valuation.

Forecasts of consolidated financial results for the fiscal year ending March 31, 2025 (Millions of yen)

*This table can be scrolled horizontally.

| Net sales | Operating profit | Ordinary profit | Profit attributable to owners of parent | |

|---|---|---|---|---|

| 1st half | 18,500 | 1,600 | 1,700 | 1,200 |

| Full year | 38,000 | 3,800 | 4,000 | 2,800 |

The Carlit Group has formulated the Mid-Term Management Plan "Challenge 2024 Grow Up Plan 2024" and will promote various initiatives to become a company that is highly valued by the market.

Future Initiatives

Medium- to Long-term Management Vision

Based on the Group's management philosophy of "For Confidence and Infinite Challenges," and looking ahead to the long term, we have determined our Vision for 2030: "Supporting happy lifestyles by combining the power of 'chemicals' and 'technology' to contribute to a sustainable society." In addition, we have introduced new business portfolio management, dividing our business portfolio into three areas: Focus Areas, Develop Areas, and Base Areas, and promoting strategies appropriate to each area, with the aim of achieving "profitable growth."

In order to realize this vision, the Group has formulated a Mid-Term Management Plan entitled "Challenge 2024," which kicked off in fiscal year 2022. Our management policy is to pursue improvements in corporate value through the optimization of our business portfolio. In line with this policy, we are currently undertaking specific measures centered on the following five strategies: (1) accelerating growth businesses; (2) expanding research and development; (3) improving the profitability of existing businesses; (4) improving ESG management; and (5) rebuilding business infrastructure. We are further enhancing our social contributions and corporate governance, thus giving tangible shape to profitable growth and ESG, while aiming to become a corporate group that is trusted by society.

Mid-Term Management Plan "Challenge 2024 Grow Up Plan 2024"

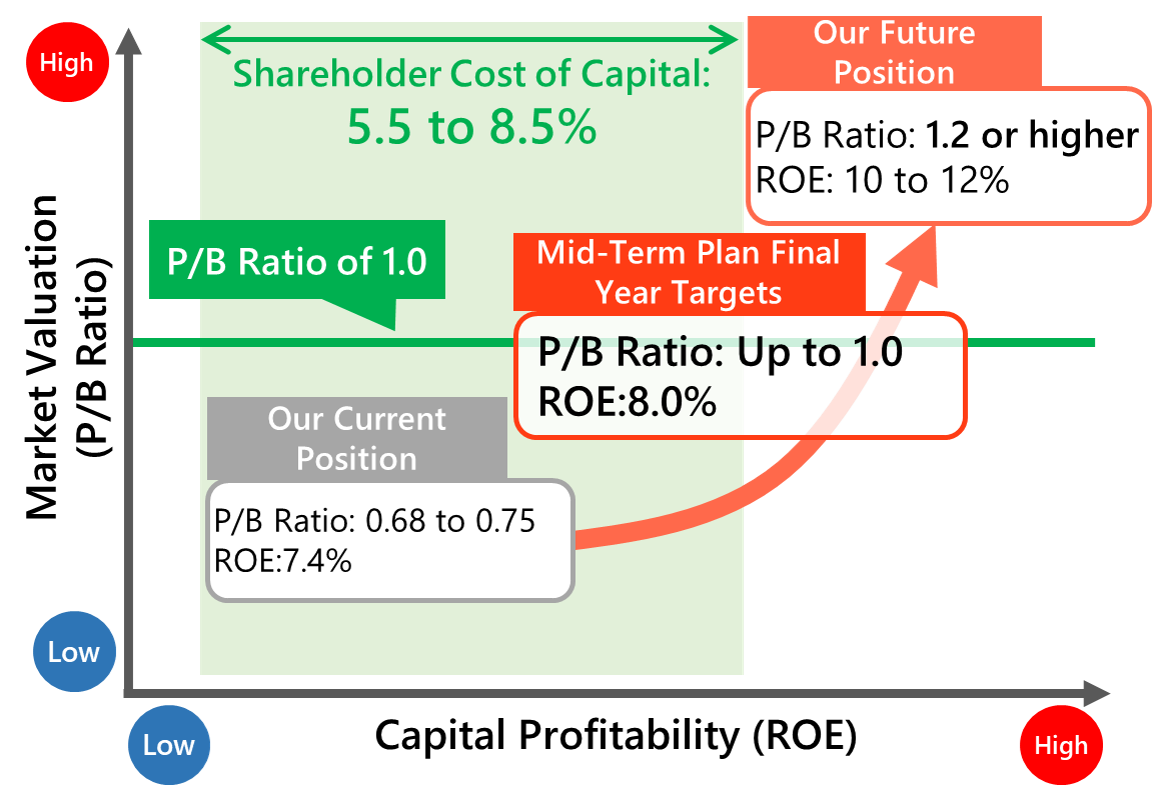

As we enter the final year of our Mid-Term Management Plan "Challenge 2024", we have formulated "Challenge 2024 Grow Up Plan 2024", a mid-term management plan following the "Challenge 2024 Rolling Plan 2023" that we formulated last year, with the aim of flexibly responding to changes in the business environment and pushing for further growth, and we are pursuing management that takes into account capital costs and our stock price. With "Grow Up Plan 2024", we analyzed capital profitability and market valuation as shown below to confirm our position, and then set PBR and ROE targets. We also updated the specific initiatives for improving these targets from "Rolling Plan 2023" highlighting the following four initiatives: "A policy for reducing cross-shareholdings," "Progress with capital investment plans and growth investments," "Fostering growth expectations by promoting R&D," and "Stable dividends linked to performance," and will provide details on our progress, target values, and more. Going forward, we will continue to pursue the achievement of the mid-term management plan and the realization of the "Ideal Carlit Group in 20302 by promoting the "Rolling Plan 2023" and "Grow Up Plan 2024" based on the "Challenge 2024" mid-term management plan.

Aim of the Three-Company Merger with Japan Carlit Co., Ltd. and Silicon Technology Corporation in October 2024

The merger between Carlit Co., Ltd. Japan Carlit Co., Ltd. and Silicon Technology Corporation, and the transition to an operating holding company system, are aimed at speeding up decision-making, streamlining administrative departments, and rebalancing personnel as part of our "Rebuild business infrastructure" strategy. With regard to promoting business portfolio management as set forth in the Mid-Term Management Plan "Challenge 2024", we aim to promote growth strategies and improve management efficiency by integrating management based on Focus and Development Areas. At a time when the environment surrounding corporate management is becoming increasingly severe, we will unite the strengths of all our employees to boldly and proactively take on challenges, provide security and prosperity through reliable manufacturing and services, and improve our corporate value by aiming to realize the "Ideal Carlit Group in 2030" based on our management philosophy of "For Confidence and Infinite Challenges". We sincerely appreciate the continued understanding and support of our shareholders.