Basic Approach to Climate Change Issues

We recognize that climate change is one of the most important management issues affecting our business activities, and we are working to mitigate it, while taking into account the risks and opportunities that climate change poses to our Group's business environment.

In light of the importance of accurately communicating the impact of climate change on our Company to our stakeholders, we have endorsed and signed the TCFD (Task Force on Climate-related Financial Disclosure).

In accordance with their recommendations, and based on information from the Intergovernmental Panel on Climate Change (IPCC) and the World Wide Fund for Nature (WWF), we have begun analyzing the "4°C scenario," in which the global average temperature rises 4°C compared to pre-industrial levels without any measures being taken, and the "1.5/2°C scenario," in which measures are taken to limit the rise in temperature to 1.5/2°C, in terms of both risk and opportunity.

We will continue to update and expand the scope of our research by improving the accuracy of our analysis and concretely reflecting the results in our management and business strategies by making the indicators more concrete, thereby improving the resilience of our management.

"Task Force on Climate-related Financial Disclosures" established by the Financial Stability Board (FSB) at the request of G20 finance ministers and central bank governors

Recommended Disclosure Items Based on the TCFD Recommendations

We will disclose climate change-related information on the following four themes recommended in the TCFD recommendations.

| Governance | The organization's governance around climate change risks and opportunities |

|---|---|

| Strategy | The actual impacts and potential threats of climate-related risks and opportunities on the organization's businesses, strategy, and financial planning |

| Risk management | The processes used by the organization to identify, assess, and manage climate change-related risks |

| Metrics and targets | The metrics and targets used to assess and manage relevant climate change-related risks and opportunities |

Governance

Expectations for companies to solve climate change and other social issues are growing rapidly, making it increasingly important for us to reflect ESG initiatives in management. The Group believes the pursuit of social value creation as well as growth is essential for achieving sustainability (medium- to long-term sustainability, including ESG factors), and is therefore carrying out promotional measures via the following promotion system (Please see here for our Sustainability Promotion System Diagram).

Promotion Framework

Our Group has established a Sustainability Committee under the supervision of the Board of Directors, chaired by the Representative Director and President and composed of all Directors and Executive Officers as well as Full-Time Audit & Supervisory Board Members, to promote activities.

The Committee deliberates on and formulates policies, strategies, plans, and measures concerning climate change and sustainability, identifies issues facing each Group company, and clarifies measures to strengthen and improve them.

Committee deliberations are reported as needed to the Group Management Strategy Meeting, Management Meeting, and Board of Directors, promoting active discussion of sustainability issues at the Board level.

The Board of Directors will promote active and proactive discussions on sustainability issues.

The committee set up an environment and climate change-related agenda and has formulated policies on carbon neutrality and environmental management, including setting CO2 emission reduction targets, calculating the Group's emissions across Scope 1, 2, and 3 to reduce supply chain emissions, and procurement policies aimed at achieving sustainable procurement.

Strategies

In accordance with TCFD recommendations, we began analyzing the "4°C scenario" and the "1.5/2°C scenario" in terms of both risks and opportunities.

The repercussions of each scenario and major impact on our Group are shown on the next table.

While climate change is a risk to our business activities, we recognize that it also represents an opportunity to enhance the value of our products and service offerings and our corporate value.

In accordance with our Basic Policy for Sustainability, we promote the provision of decarbonization products and services that address climate change and limit its progression, and the creation of new businesses.

We aim to improve the accuracy of our analysis and assessment of the real and potential impacts of climate change risks and opportunities on our business activities, strategic and financial plans, and identify key impacts of high priority, and consider countermeasures.

These results will be supervised by the Board of Directors, and efforts will be made to reflect them concretely in management strategies as appropriate to improve management resilience, and will be disclosed as soon as they become available.

The repercussions of each scenario and major impact on our Group

*This table can be scrolled horizontally.

| Scenario | Category | Major Impact | Risk and Opportunity | Potential Impact | Assumed Economic Impact | ||

|---|---|---|---|---|---|---|---|

| 4°C | Risk | Physical risk*1*1 | Acute risk*2 | Changes in precipitation and weather patterns | Increase in torrential rains and other severe wind and flood damage | Damage to production facilities, production stagnation and reduced efficiency, and rising flood control costs | Increase in equipment repair costs Increase in manufacturing costs |

| Rise in average temperatures | Soaring prices of raw materials due to a decrease in suitable areas for growing coffee and tea | Shrinkage of sales in the Bottling segment | |||||

| Chronic risk*3 | Changes in precipitation and weather patterns | Water shortage due to changes in precipitation | Decreased operation of hydroelectric power plants and increased costs associated with securing alternative water sources and introducing water reuse systems | Increase in energy costs Increase in manufacturing costs |

|||

| Rise in average temperatures | Impact on air conditioning equipment in warehouses and factories | Increase in energy costs | |||||

| Opportunities | Markets, products, and services | Changes in precipitation and weather patterns | Increased demand for products and services that adapt to the intensifying storm and flood damage | Increase production of flares with escape mechanisms for when a vehicle is submerged in water | Sales growth in Explosives | ||

| Increased demand for products and services due to rising average temperatures | Increased demand for PET bottled and canned beverages | Expansion of sales in the Bottling segment | |||||

| Increased demand for industrial water treatment agents for odor control | Expansion of sales in the chemicals business | ||||||

| <1.5/2°C | Risk | Migration risk*4 | Legal and regulatory risk | Changes in social demands | Strengthening and tightening of emission regulations, such as the introduction of a carbon tax | Introduction of environment-friendly equipment, full-scale introduction of emissions trading and application of carbon tax | Increase in capital investment costs Increase in operation costs Increase in raw material procurement costs |

| Technology risk | Development and diffusion of low-carbon emission technologies | Social demand for low-carbon emission technologies | Deterioration of competitiveness due to delayed action for lowcarbon technologies | Increase in capital investment costs Decline in the number of distributors |

|||

| Reputation risk | Changes in social demands | Requests for disclosure of data on progress in Climate Change Action | Stricter criteria for trading and investment decisions, poor reputation due to delays in action | Increase in fund procurement costs Decline in the number of suppliers and distributors |

|||

| Opportunities | Markets, products, and services | Changes in precipitation and weather patterns | Increased demand for products and services that adapt to ongoing climate change | Increased demand for meteorological satellite launches | Expansion of sales in the chemicals business | ||

| Widespread use of renewable energy | Increase in demand for products and services that contribute to climate change mitigation | Popularization of electric vehicles and increase in storage battery demand | Expansion of sales in the material assessment service and electronic materials businesses | ||||

| Widespread use of hydrogen energy and large-capacity storage batteries | Expansion of sales in the chemicals business | ||||||

| Resource efficiency | Diffusion of energy-saving environment | Diffusion of energy-saving production facilities Stable market distribution of renewable energy |

Establishment of highly energy-efficient production systems, utilization of hydroelectric power plants, expansion of photovoltaic power generation, and promotion of non-fossil certified electricity use | Reduction of energy costs Reduction of operation costs |

|||

| Reputation | Changes in social demands | Requests for disclosure of data on progress in Climate Change Action | Improvement of external reputation by enhancing Climate Change Action | Reduction in fund procurement costs Expansion of suppliers and distributors |

|||

- Physical risk: Disasters and other damage caused by climate change.

- Acute risk: Impact of extreme weather events such as typhoons, floods, storm surges, etc.

- Chronic risk: Impacts from long-term changes in precipitation patterns, changes in weather patterns, and increases in average temperatures and sea levels.

- Transition risk: Risks arising from the transition to a decarbonized society aimed at mitigating climate change.

Risk Management

Natural disasters, outbreaks of infectious diseases, and other factors may have a significant impact on the economic environment, cause damage to production facilities, harm human resources, and also cause major changes in customer demand.

We recognize that these are among the key risk factors that could significantly affect our performance and financial position.

In order to further strengthen risk management and take appropriate measures, the Corporate Planning Department is responsible for major impacts on the economic environment, the Human Resources Department and the General Affairs Department are responsible for major harm to personnel, and the Sustainability Group is responsible for disclosing these to stakeholders in a timely and appropriate manner.

Furthermore, the Production and Quality Management Department was established in fiscal 2021 to strengthen risk management for production activities and product quality.

We also established a Group Risk Management Committee chaired by the Representative Director and President to establish a comprehensive risk management framework, including climate change risks.

We have established a Group Risk Management Committee chaired by the Representative Director and President, building a comprehensive risk management system that includes climate change, where risk information from Group companies is promptly consolidated and reported to management, impacts across the Group are verified, and risks are minimized through swift management decisions and countermeasures.

Indicators and Targets

Global warming caused by climate change has resulted in extreme weather events, such as torrential rains, heat waves and droughts, which have caused significant damage to the natural environment, including floods and droughts.

Our Group recognizes that climate change is one of the most important social issues to be resolved, especially since the Group is built on the bounty of abundant natural resources such as water.

To achieve carbon neutrality by 2050, we will actively work to reduce greenhouse gas emissions by promoting energy conservation measures and the use of renewable energy.

We will also strive to improve the scope of disclosure of energy consumption and CO2 emissions data.

Supply chain emissions

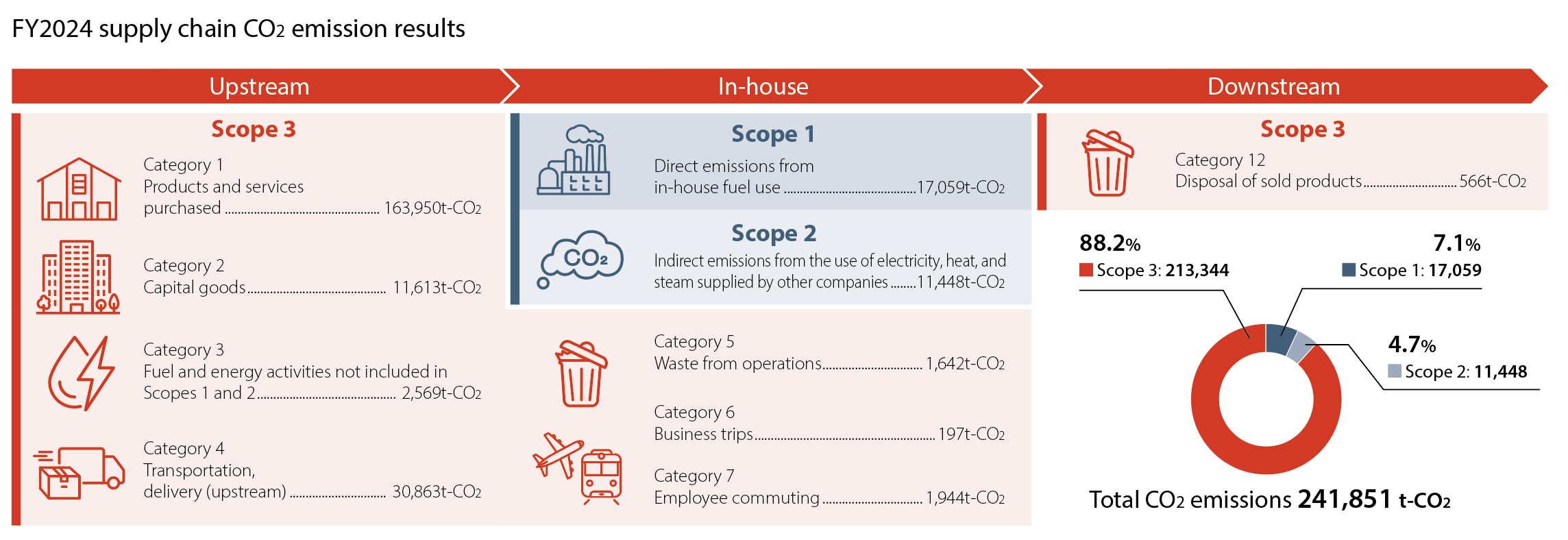

Our Group has calculated supply chain CO2 emissions (Scope 1, 2, and 3) as an indicator to measure and manage risks and opportunities related to climate change.

We will work to reduce greenhouse gas emissions by establishing a framework for regular management of real emissions.

Actual supply chain CO2 emissions in FY2023

Results for Carlit Holdings Co., Ltd., Japan Carlit Co., Ltd., JC Bottling Co., Ltd., Silicon Technology Corporation, Namitakiko Co., Ltd., Toyo Spring Industrial Co., Ltd., and Fuji Shoji Co., Ltd.

Company names as of FY2023

- Direct emissions from in-house fuel use

- Indirect emissions from the use of electricity, heat and steam supplied by other companies

- Indirect emissions that occur in upstream (raw materials, transportation, commuting, etc.) and downstream (use and disposal of products, etc.) activities

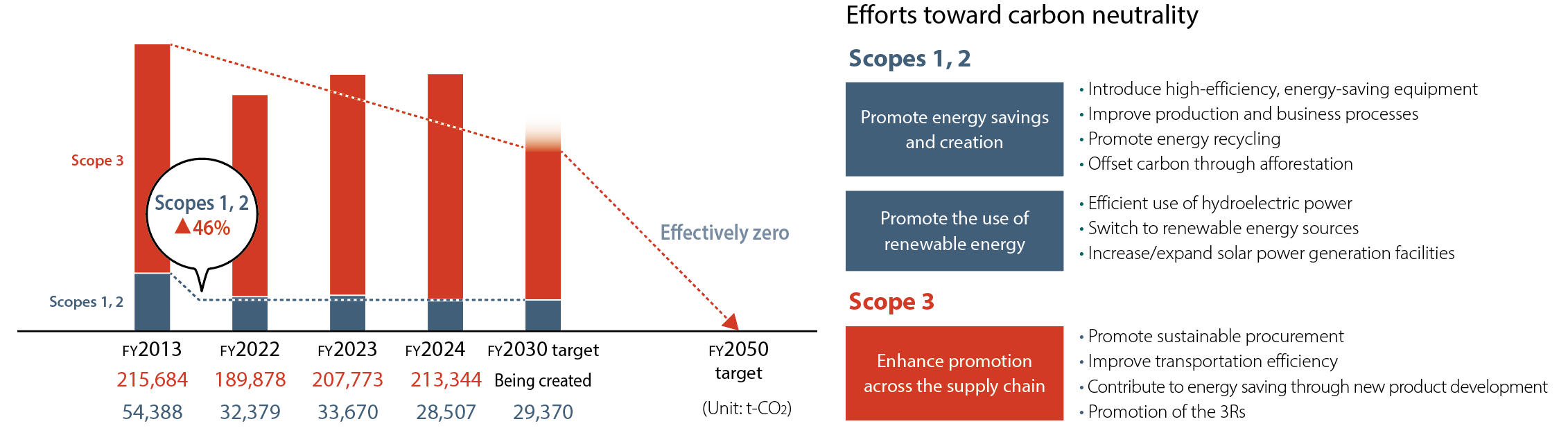

Supply chain emission reduction targets

To realize a sustainable society, we are committed to achieving carbon neutrality throughout our business activities and supply chain by 2050.

For Scope 1 and 2, we have set a milestone of a 46% reduction compared to the fiscal 2013 level by 2030.

To achieve our goals, we will work to promote energy conservation and energy creation, promote the use of renewable energy, and expand the scope of information disclosure on related energy consumption.

Scope 3 emissions account for approximately 80% of the Group's total emissions, and we recognize that reducing Scope 3 emissions is essential to achieving a decarbonized society.

In particular, Category 1, which corresponds to products and services purchased, accounts for approximately 70% of Scope 3.

In order to achieve decarbonization through the supply chain, we will work to strengthen communication with suppliers through sustainable procurement questionnaires and emission accounting systems, and promote efforts to reduce carbon emissions. We will also work to set Scope 3 reduction targets by 2030 with a view to achieving carbon neutrality by 2050.